Regret (decision theory)

Regret (often also called opportunity loss) is defined as the difference between the actual payoff and the payoff that would have been obtained if a different course of action had been chosen. This is also called difference regret. Furthermore, the ratio regret is the ratio between the actual payoff and the best one.

Contents |

Minimax regret

The minimax regret approach is to minimize the worst-case regret[1]. The aim of this is to perform as closely as possible to the optimal course. Since the minimax criterion applied here is to the regret (difference or ratio of the payoffs) rather than to the payoff itself, it is not as pessimistic as the ordinary minimax approach. Similar approaches have been used in a variety of areas such as:

One benefit of minimax (as opposed to expected regret) is that it is independent of the probabilities of the various outcomes: thus if regret can be accurately computed, one can reliably use minimax regret. However, probabilities of outcomes are hard to estimate.

This differs from the standard minimax approach in that it uses differences or ratios between outcomes, and thus requires interval or ratio measurements, as well as ordinal measurements (ranking), as in standard minimax.

Maximin example

Suppose an investor has to choose between investing in stocks, bonds or the money market, and the total return depends on what happens to interest rates. The following table shows some possible returns:

| Return | Interest rates rise | Static rates | Interest rates fall | Worst return |

|---|---|---|---|---|

| Stocks | −4 | 4 | 12 | −4 |

| Bonds | −2 | 3 | 8 | −2 |

| Money market | 3 | 2 | 1 | 1 |

| Best return | 3 | 4 | 12 |

The crude maximin choice based on returns would be to invest in the money market, ensuring a return of at least 1. However, if interest rates fell then the regret associated with this choice would be large. This would be −11, which is the difference between the 1 received and the 12 which could have been received if the outturn had been known in advance. A mixed portfolio of about 11.1% in stocks and 88.9% in the money market would have ensured a return of at least 2.22; but, if interest rates fell, there would be a regret of about −9.78.

The regret table for this example, constructed by subtracting best returns from actual returns, is as follows:

| Regret | Interest rates rise | Static rates | Interest rates fall | Worst regret |

|---|---|---|---|---|

| Stocks | −7 | 0 | 0 | −7 |

| Bonds | −5 | −1 | −4 | −5 |

| Money market | 0 | −2 | −11 | −11 |

Therefore, using a minimax choice based on regret, the best course would be to invest in bonds, ensuring a regret of no worse than −5. A mixed investment portfolio would do even better: 61.1% invested in stocks, and 38.9% in the money market would produce a regret no worse than about −4.28.

Regret theory

Regret theory is a model of choice under uncertainty. Developed by Graham Loomes and Robert Sugden, it generalizes the minimax regret approach[2]. Choice is modelled as the minimising of a function of the regret vector, defined as the difference between the outcome yielded by a given choice and the best outcome that could have been achieved in that state of nature.

Example: Linear estimation setting

What follows is an illustration of how the concept of regret can be used to design a linear estimator. The regret is the difference between the mean-squared error (MSE) of the linear estimator that doesn't know the parameter  , and the mean-squared error (MSE) of the linear estimator that knows

, and the mean-squared error (MSE) of the linear estimator that knows  . Also, since the estimator is restricted to be linear, the zero MSE cannot be achieved in the latter case.

. Also, since the estimator is restricted to be linear, the zero MSE cannot be achieved in the latter case.

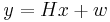

Consider the problem of estimating the unknown deterministic parameter vector  from the noisy measurements in the linear model

from the noisy measurements in the linear model

where  is a known

is a known  matrix with full column rank

matrix with full column rank  , and

, and  is a zero mean random vector with covariance matrix

is a zero mean random vector with covariance matrix  , which models the noise.

, which models the noise.

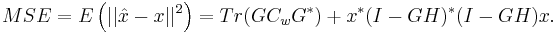

Let

be a linear estimate of  from

from  , where

, where  is some

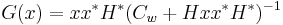

is some  matrix. The MSE of this estimator is given by

matrix. The MSE of this estimator is given by

Since the MSE depends explicitly on  it cannot be minimized directly. Instead, the concept of regret can be used in order to define a linear estimator with good MSE performance. To define the regret here, consider a linear estimator that knows the value of the parameter

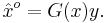

it cannot be minimized directly. Instead, the concept of regret can be used in order to define a linear estimator with good MSE performance. To define the regret here, consider a linear estimator that knows the value of the parameter  , i.e. the matrix

, i.e. the matrix  can explicitly depend on

can explicitly depend on  :

:

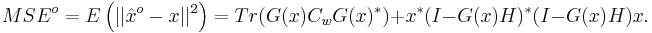

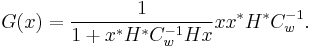

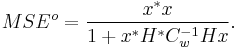

The MSE of  is

is

To find the optimal  , it is differentated with respect to

, it is differentated with respect to  and equated to 0 getting

and equated to 0 getting

and using the Matrix Inversion Lemma

Substituting this  back into

back into

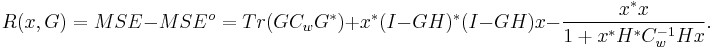

This is the smallest MSE achievable with a linear estimate that knows  . In practice this MSE cannot be achieved, but it serves as a bound on the optimal MSE. The regret is defined by

. In practice this MSE cannot be achieved, but it serves as a bound on the optimal MSE. The regret is defined by

The minimax regret approach here is to minimize the worst-case regret as defined above. This will allow a performance as close as possible to the best achievable performance in the worst case of the parameter  . Although this problem appears difficult, it can be formulated as a convex optimization problem and solved definitely. For details of this see Eldar, Tal and Nemirovski (2004)[3]. Similar ideas can be used when

. Although this problem appears difficult, it can be formulated as a convex optimization problem and solved definitely. For details of this see Eldar, Tal and Nemirovski (2004)[3]. Similar ideas can be used when  is random with uncertainty in the covariance matrix. For this see Eldar and Merhav (2004), and Eldar and Merhav (2005)[4][5].

is random with uncertainty in the covariance matrix. For this see Eldar and Merhav (2004), and Eldar and Merhav (2005)[4][5].

References

- ^ Savage, L.J. (I95I). The theory of statistical decision. Journal of the American Statistical Association, vol. 46, pp. 55-67.

- ^ Loomes, G. and Sugden, R. (1982), ‘Regret theory: An alternative theory of rational choice under uncertainty’, Economic Journal, 92(4), 805–24.

- ^ Y. C. Eldar, A. Ben-Tal, and A. Nemirovski, "Linear Minimax regret estimation of deterministic parameters with bounded data uncertainties," IEEE Trans. Signal Process., vol. 52, no. 8, pp. 2177–2188, Aug. 2004.

- ^ Y. C. Eldar and Neri Merhav, "A Competitive Minimax Approach to Robust Estimation of Random Parameters," IEEE Trans. Signal Processing, vol. 52, pp. 1931-1946, July 2004.

- ^ Y. C. Eldar and Neri Merhav, "Minimax MSE-Ratio Estimation with Signal Covariance Uncertainties," IEEE Trans. Signal Processing, vol. 53, no. 4, pp. 1335-1347, Apr. 2005.